PAN (permanent account number) is a unique 10-digit alphanumeric identity issued to each taxpayer by the Income Tax Department under the supervision of the Central Board of Direct Taxes. It also serves as an identity proof.

The primary purpose of the PAN is to bring a universal identification to all financial transactions and to prevent tax evasion by keeping track of financial transactions, especially those of high-net-worth individuals who can impact the economy.

The PAN is mandatory for a majority of financial transactions.

History of PAN:

Earlier, there was a General Index Register (GIR) Number to identify the taxpayer by the Income tax Department. This was essentially a manual system. The GIR number was unique only within an Assessing Officers Ward / Circle and not throughout the country.

To overcome these weaknesses, PAN (old series) was first introduced in 1972 and made statutory u/s 139A of the Act w.e.f. 1st April, 1976.

However, the PAN under old series failed to meet the desired objectives for following reasons:

- The allotment of PAN was not centralized.

- No database was maintained and there was no check to avoid allotment of multiple PANs to a taxpayer.

- Captured data was not structured and was limited to very few parameters – Name, Address, Status and designation of A.O.

PAN under new series

Section 139A of the Act was amended w.e.f. 1.7.95 to enable allotment of PAN under new series to persons residing in areas notified by the Board. Applications for allotment of PAN under new series were made mandatory in Delhi, Mumbai and Chennai w.e.f. 1.6.96, and in rest of the country w.e.f. 11.2.98.

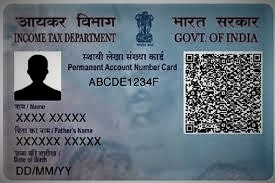

Structure of PAN: AAA P L 1234 C

- PAN card is issued under Section 139A of the Income Tax Act.

- The PAN structure is as follows: AAAPL1234C:

- First five characters are letters, next four numbers, and last character letter.

- The first three letters are sequence of alphabets from AAA to ZZZ

- The fourth character informs about the type of holder of the card. Each holder is uniquely defined as below:

- A — Association of Persons (AOP)

- B — Body of Individuals (BOI)

- C — Company

- F — Firm

- G — Government

- H — HUF (Hindu Undivided Family)

- L — Local Authority

- J — Artificial Juridical Person

- P — Individual

- T — AOP (Trust)

- K — Krish (Trust Krish)

- The fifth character of the PAN is the first character of;

- the surname or last name of the person, in the case of a “Personal” PAN card, where the fourth character is “P” or

- the name of the Entity, Trust, society, or organisation in the case of Company/ HUF/ Firm/ AOP/ BOI/ Local Authority/ Artificial Judicial Person/ Govt, where the fourth character is “C”,”H”,”F”,”A”,”T”,”B”,”L”,”J”,”G”.

- The last character is an alphabetic check digit.

The DOI (date of issue) of the PAN card is mentioned at the right (vertical) hand side of the photo on the PAN card if issued by NSDL and will not be mentioned if issued by UTI-TSL.

Holding of more than one PAN not allowed:

A person cannot hold more than one PAN. Penalty for each default is liable to be imposed under the Income Tax Act, 1961 for having more than one PAN. If a person has been allotted more than one PAN then he should immediately surrender the additional PAN card(s).

Obtaining PAN:

To have a PAN is optional and voluntary like passport, driving license, Aadhaar etc. However, its use is mandatory at required places, like PAN for high-value financial transactions etc.

Uses of PAN:

- Every person if his total income in respect of which he is assessable during the year exceeds the maximum amount which is not chargeable to tax.

- A charitable trust who is required to furnish return under Section 139(4A)

- Every person who is carrying on any business or profession whose total sale, turnover, or gross receipts are or is likely to exceed twenty lakh rupees for service and forty lacs rupees for other cases in any year.

- Every importer/exporter who is required to obtain Import Export code.

- Every person who is entitled to receive any income after TDS.

- Any person who is liable to pay excise duty or a producer or manufacturer of excisable goods or a registered person of a private warehouse in which excisable goods are stored and an authorized agent of such person

- A person who is liable to pay the Goods & Service Tax and his agent

- Every person who intends to enter into specified financial transactions in which quoting of PAN is mandatory

Types of PAN Cards:

PAN Card for Individuals:

A PAN card for organizations is similar to that for individuals, with the exception that there is no photograph on the physical PAN card. Also in lieu of the date of birth mentioned on individual PAN cards, the date of registration of the company/organization is mentioned.

PAN Card for Companies:

A PAN card for organizations is similar to that for individuals, with the exception that there is no photograph on the physical PAN card. Also in lieu of the date of birth mentioned on individual PAN cards, the date of registration of the company/organization is mentioned.

PAN for foreign citizens in India:

All foreign citizens who wish to start business in India or wish to invest in India are required to obtain PAN. The procedure is same as applicable to resident Indians. However, the application form for foreigners is form 49AA .

Concepts Similar to PAN Card:

The concept of a PAN card, or a unique number assigned to every tax paying entity is not a new concept. In fact, there are a number of similar such utilities that are used for tax purposes.

TAN

TAN (Tax Deduction and Collection Account Number) – This is a unique 10 digit number that is issued to individuals and entities who have to collect or deduct tax on payments they made as part of tax Deducted at Source (TDS) under the Income Tax Act.

The TAN has to be quoted when applying for TDS or Tax Collected at Source (TCS) challans made to disburse the refund as well as on certificates. Failure to quote the TAN would result in a fine under Income Tax Act, 1961.

GSTN

GSTN (Goods and Service Tax Identification Number) – A GSTN number is a unique 13 digit number that is used to identify dealers who are registered under the Goods and Service Tax Act. This number is to be quoted when generating invoices, orders or quotations by both the issuing as well as the receiving company.

Concerns with PAN Cards:

More than 24.37 crore Permanent Account Numbers (PAN) have been registered in the country till now, according to latest data.