Journal Entry

In the age of manual accounting system, business transactions are first noted in a Journal Book. The journal entries are punched in a journal in order by date and are then posted into the proper accounts in General Ledger.

Journal will contain of the following:

- Date of transaction

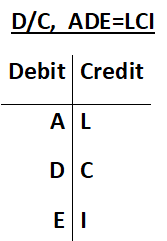

- Amount & account that will be debited in journal

- amount & account that will be credited in journal

- a short description /narration

Under computerised accounting system environment software will automatically punched business transactions into the general ledger.

List of Journal Entries in Video

- 1. Capital introduced

- 2. Withdrawal from Business

- 3. Purchase of Material

- 4. Sale of Material

- 5. Salary Payment

- 6. Interest Income

1.1. Mr. Modi introduced Rs. 10000/- is the business as capital

| PARTICULARS | DR | CR |

| Cash A/c To Mr. Modi Capital Capital A/c (Capital Introduced) | 10000.00 | 10000.00 |

1.2. Mr. Modi withdraw Rs. 600/- for his personal use

| PARTICULARS | DR | CR |

| Drawing A/c To Cash A/c (Amount withdrawn for personal use) | 600.00 | 600.00 |

1.3. Mr. Modi Purchased goods for Rs. 5000/-

| PARTICULARS | DR | CR |

| Purchase A/c To Cash A/c (Material purchased ) | 5000.00 | 5000.00 |

1.4. Mr Modi sold material for Rs. 6000/-

| PARTICULARS | DR | CR |

| Cash A/c To Sales A/c (Material purchased ) | 6000.00 | 6000.00 |

1.5. Mr Modi paid salary of Rs. 400/- against Salary

| PARTICULARS | DR | CR |

| Salary A/c To Cash A/c (Salary paid ) | 400.00 | 400.00 |

1.6. Interest received Rs. 300/-

| PARTICULARS | DR | CR |

| Cash A/c To interest A/c (Salary paid ) | 300.00 | 300.00 |