Credit transaction means any transaction by the terms of which the payment for business transaction is to be made at a future date.

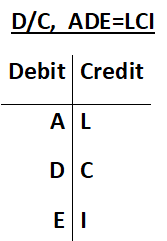

For credit transaction we directly debit or credit in the name of person or company

Credit journal entries refer to a transaction in which the amount payable or receivable will be paid or received at a later date. E.g. Credit sales and Credit purchases.

List of Journal Entries in Video

- Capital introduced

- Withdrawal from business

- Purchase of Material

- Sale of Material

- Salary Payment

- Interest Income

2.1. Mr. Bharat introduced Rs. 20,000/- is the business as capital

| PARTICULARS | DR | CR |

| Cash A/c To Mr. Bharat’s Capital A/c (Capital Introduced) | 20,000.00 | 20,000.00 |

2.2. Mr. Bharat withdrawn Rs. 1,200/- for his personal use

| PARTICULARS | DR | CR |

| Drawing A/c To Cash A/c (Amount withdrawn for personal use) | 1,200.00 | 1,200.00 |

2.3. Mr. Bharat purchased goods of Rs 10,000.00 from Ramesh on credit.

| PARTICULARS | DR | CR |

| Purchase A/c To Ramesh A/c (Material purchased ) | 10,000.00 | 10,000.00 |

2.4. Goods of Rs. 12,000 sold to Mr. Shyam on credit.

| PARTICULARS | DR | CR |

| Shyam,s A/c To Sales A/c (Material purchased ) | 12,000.00 | 12,000.00 |

2.5. Salary for last month of the year of Rs. 800 paid in the next financial year.

| PARTICULARS | DR | CR |

| Salary A/c To Salary Payable A/c (Salary paid ) | 800.00 | 800.00 |

2.6. Interest amount of Rs. 600 for the last month of year received in next financial year.

| PARTICULARS | DR | CR |

| Interest Receivable A/c To interest A/c (Salary paid ) | 600.00 | 600.00 |