Dissolution of a partnership firm is the process by which the existence of a partnership firm comes to an end. This involves the sale or disposal of assets, settlement of liabilities and closing of books of accounts. Once the outside liabilities of the firm are settled, the partners take away their capital investment. If there is any surplus or deficit in this process it will be shared by the partners in their profit sharing ratio.

Reasons of Dissolution of a partnership firm:

Dissolution of a partnership firm can take place on account of any of the following reasons:

1. Dissolution by Agreement:

When the partners themselves reach an agreement to discontinue their business for whatever reason, it is known as dissolution by agreement.

2. Compulsory Dissolution:

Compulsory dissolution takes place when the business of the firm is declared illegal, or the partners become insolvent or the citizen of an enemy country happens to be partner of the firm.

3. Dissolution by notice:

A partner can demand dissolution of a partnership at will, by serving a notice to the firm.

4. Dissolution by Court:

Court may initiate dissolution of a firm under the following circumstances:

i) When one of the partners has become of unsound mind

ii) When a partner is guilty of misconduct which may affect the business

iii) When a partner commits wilful breach of contract

iv) Any other reason which the court may find adequate

5. Dissolution by the expiry of a pre determined period or completion of event:

This dissolution takes place in case of particular partnerships which are formed for a specific period or the completion of a specific project. Such partnerships will be dissolved at the completion of the specific period of or the project as the case may be.

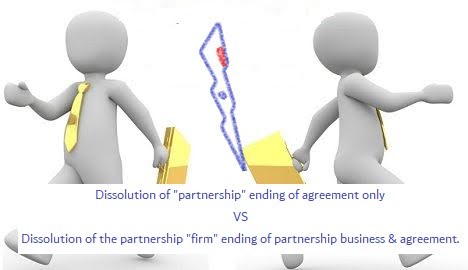

Dissolution of Partnership and Dissolution of Partnership Firm

The term dissolution, referred in relation to a partnership business generally denotes the winding up of the business. However, there is a difference between ‘dissolution of partnership’ and ‘dissolution of the partnership firm’. The former indicates ending of agreement only to replace it with a new one, but the latter indicates the ending of partnership business altogether. The following points may be noted in comparison between the two:

Dissolution of Partnership

- Only the agreement is dissolved, no physical disposal takes place.

- The partners will continue to run the business with a new agreement.

- Limited effect on employees or debtors and creditors of the business

- Many dissolutions of agreement can take place during the life of a partnership business.

- Admission, retirement and or death of a partner can result in compulsory dissolution of existing agreement.

Dissolution of Partnership Firm

- The Firm is dissolved, by selling off assets and settling liabilities.

- The partners will discontinue the business

- Since the business is closed down it affects the workers, debtors and creditors of the firm

- Dissolution of firm can take place only once in the lifetime of a partnership business.

- None of these events can lead to a compulsory dissolution of the firm.

Settlement of Accounts on Dissolution

The first step in dissolution is the realisation of assets followed by the settlement of outside liabilities. All individual accounts for assets and liabilities, except cash, are closed by transferring their balances to a Realisation Account. Realisation account is the temporary account for accumulating all assets and liabilities for convenient accounting treatment. All ledger accounts except partner’s capital accounts and cash account are closed prior to realisation procedure. Accumulated profits or losses are directly transferred into the capital accounts in the profit sharing ratio. The following is the order of priority in settlement of liabilities and capital upon dissolution:

i) Expense incurred on realisation of assets such as commission, cartage, brokerage etc.

ii) All outside creditors

iii) Partner’s Loan accounts

iv) Balances in Capital Accounts of partners

Special Items in Accounting for Dissolution

1. Realisation Account:

This is the most important account prepared to facilitate dissolution of firms. This is equal in importance to Revaluation Account in Reconstitution. There is no scope of revaluation of assets and liabilities of a firm under liquidation. Realisation account is used to accumulate all assets and liabilities in one place for convenient accounting steps for disposal and settlement of liabilities.

2. Treatment of Goodwill:

Goodwill is the most prominent item in Reconstitution of partnership. But goodwill does not have any special treatment in dissolution. If it appears in the books it has to be transferred into Realisation Account. This will automatically gets transferred into the Capital Accounts of Partners, by way of realisation profit or loss. If goodwill does not appear in the books it is just ignored. There is no meaning in raising it or treating it in any way when the firm is being dissolved.

3. Realisation Expenses:

Expenses of realisation such as commission paid to brokers for the disposal of assets, expenses on transportation of items, registration documentation charges for the assets sold etc. are debited to Realisation Account and credited to Cash Account. However if any partner agrees to bear the expense for a certain fees, the fees charged by the partner becomes the common expense which is debited in Realisation Account; whereas the actual realisation expense, if mentioned, should be treated as personal drawing of the partner concerned.

4. Wife’s Loan:

Loans from a partners’ wife is to be treated as normal creditor. The basic aim of providing a loan in the name of partner’s wife is to by-pass the legal restrictions on the Loan from a Partner to the firm.

5. Provident Fund:

Provident fund should be understood as a liability payable to the employees. It should be paid off even when the question is silent about its treatment. Same rule applies to all other outside liabilities, such as creditors, bills payable etc.

6. Specific Funds:

Specific funds such as Investment Fluctuation Funds are preferably credited to Realisation account along with the transfer of related asset, which will get transferred to capital accounts by way of profit of loss on Realisation. Provision for doubtful debts, accumulated depreciation etc. must be credited to Realisation Account along with the transfer of assets.

7. Profits Kept Aside:

General Reserve; credit balance in P& L Account etc should be directly transferred into the Capital Accounts of Partners, in the profit sharing ratio.

8. Unrecorded Assets:

Unrecorded assets or assets which are completely written off may fetch some cash at the time of dissolution. There is no need of bringing them into books and selling them afterwards. It can be directly treated by crediting realisation account and debiting cash account.

9. Creditors Purchasing Some Assets in Part Settlement of Claim:

When creditors purchase some of the assets in part settlement, this is not specifically recorded by way of a journal entry, since the asset and liability are appearing in the same Realisation Account. The balance amount due to the creditors is aid in full satisfaction of the claim. If the value of asset taken over is more than the amount due, the creditors will pay the excess amount to the firm.

Please note: The treatment of creditors taking over part of the assets mentioned above is a questionable accounting treatment. What I mentioned above is only on ‘examination point of view’. The correct account treatment is to debit the Creditors account in the Ledger by passing a journal entry and transferring the balance of creditors into Realisation Account

Profit or loss on realization will be transferred to the Capital Accounts of partners in the profit sharing ratio. At the final stage of the realization process, only Cash Account and Capital Accounts will be left. The final balances of each other will match exactly, and the cash will be paid off to capital accounts to close both the accounts. This is the last transaction in the books of the firm.

The entire accounting steps in realization can be summarized as follows:

Step 1: Reduce the Number of Accounts into THREE: As you are aware each item in a detailed Balance Sheet represents an account in the Ledger. You have to reduce them into just three accounts, namely

i) Realisation Account

ii) Capital Accounts of Partners (considered one account)

iii) Cash Account

Step 2: Reduce the Number of Accounts into TWO: Major activities of realisation process take place at this stage. Sell assets one by one and add it to (debit) Cash and reduce it from (credit) Realisation Account. Take out cash and pay to liabilities placed in the Realisation Account. Now the Realisation Account is reduced to a residue, without any active accounts inside. This balance is transferred into capital accounts as realisation profit or loss. Now you have only two accounts, the Cash Account and the Capital Account.

Step 3: Reduce the Number of Accounts to NIL: This is the most interesting step. Here the cash balance has to be exactly equal to the credit balance in capital account. Take out cash (cr); Pay off Capital (Dr.), and there ends the Partnership Business.

Journal Entries in Dissolution

Accounting for dissolution begins with the closing of assets and liabilities accounts by transferring them to Realisation Account.

i) For transfer of assets

Realisation Account Dr. To Asset Account

ii) For Transfer of liabilities

Liability Account Dr. To Realisation Account

Accumulated profits such as General Reserves, Profit and Loss Account Credit Balance etc. are transferred to capital Accounts in the profit sharing ratio.

iii) For transfer of accumulated profits

General Reserve; P&L etc. Dr.

To Realisation Account

Note: Provision for doubtful debts; Investment fluctuation fund etc. are credited to realization account and ignored thereafter. These are internal provisions having no claim against the firm and therefore these amounts will merge into realization profit or loss and finally get transferred to Capital Accounts of partners.

iv) For assets realized

Cash/Bank account Dr. To Realisation Account

v) For Liabilities paid off

Realisation Account Dr.

To Cash Account

vi) For asset taken over by a partner

Partner’s Capital Account Dr.

To Realisation Account

vii) For Liability taken up by the partner

Realisation Account Dr.

To Partner’s Capital Account

viii) For unrecorded asset taken over by a partner

Partner’s Capital Account Dr.

To Realisation Account

ix) Unrecorded Liability settled by the firm

Realisation Account Dr.

To Cash account

x) Realisation expense

Realisation Account Dr. To Cash

xi) Asset taken over by creditors

No entry; Only settlement of balance amount is shown in the books.