Live information, also known as real-time or up-to-date information, is highly valuable to accountants for several reasons:

- Timely Decision-Making:

- Accurate Financial Reporting:

- Risk Management:

- Budgeting and Forecasting:

- Cash Flow Management:

- Audit and Compliance:

- Performance Monitoring:

- Cost Control:

- Efficient Collaboration:

- Technology Integration:

- Timely Decision-Making: Live information enables accountants to make decisions based on the most current data. This is crucial for adapting to rapidly changing business environments and making informed decisions in a timely manner.

- Accurate Financial Reporting: Having access to live information ensures that financial reports are accurate and reflective of the current financial position of a business. This is essential for compliance with accounting standards and regulatory requirements.

- Risk Management: Live information allows accountants to identify and address financial risks promptly. By monitoring financial data in real time, accountants can detect potential issues and take proactive measures to mitigate risks.

- Budgeting and Forecasting: Accurate and timely information is critical for budgeting and forecasting. Live data allows accountants to adjust budgets and forecasts based on the most recent financial performance, helping organizations plan for the future effectively.

- Cash Flow Management: Live information is essential for managing cash flow efficiently. Accountants can monitor incoming and outgoing cash in real time, enabling them to make decisions to optimize cash flow and address any liquidity challenges promptly.

- Audit and Compliance: Real-time information facilitates smoother audits and ensures compliance with accounting standards and regulations. It provides auditors with access to the most current financial data, making the audit process more efficient and reliable.

- Performance Monitoring: Live information allows accountants to monitor the performance of different departments, projects, or business units in real time. This helps in identifying areas of improvement, optimizing resource allocation, and ensuring that the organization is meeting its financial goals.

- Cost Control: With live information, accountants can closely monitor costs as they occur. This proactive approach to cost control helps in identifying cost overruns or deviations from budgets early on, allowing for timely corrective actions.

- Efficient Collaboration: Live information facilitates collaboration among different departments and stakeholders. Accountants can share real-time financial data with relevant parties, fostering better communication and coordination within the organization.

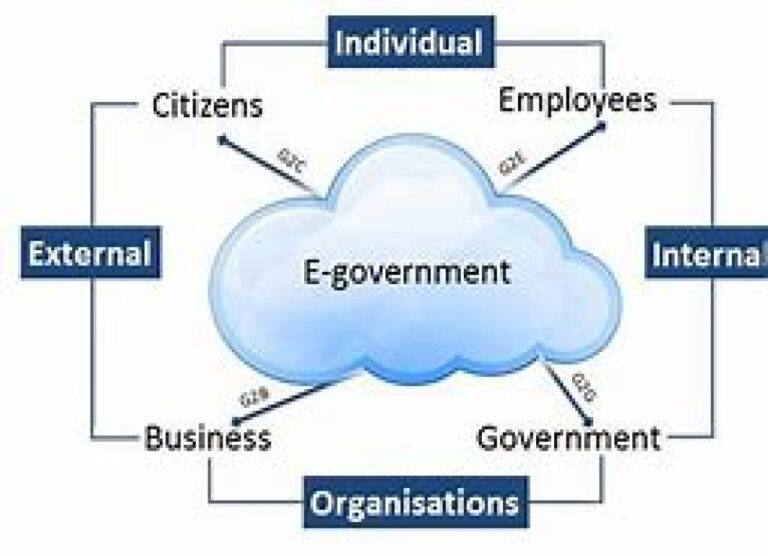

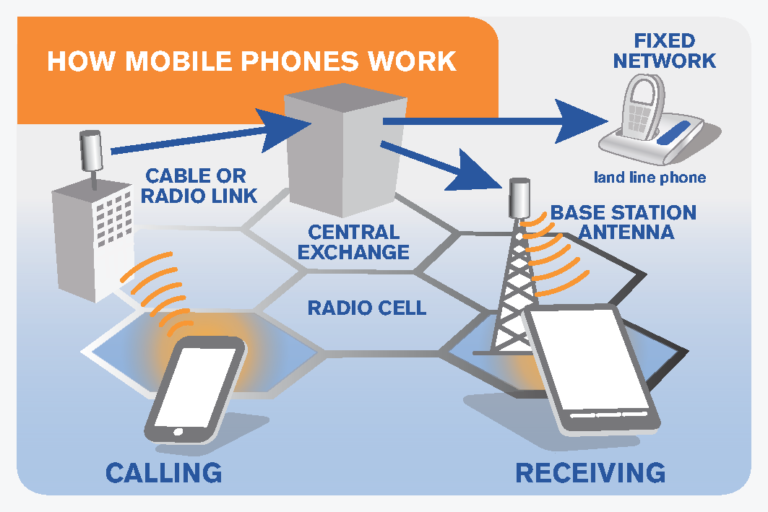

- Technology Integration: The use of technology, such as accounting software and integrated systems, allows accountants to access live information seamlessly. This integration streamlines processes, reduces manual errors, and enhances the overall efficiency of accounting operations.

In summary, live information is invaluable to accountants as it supports informed decision-making, ensures financial accuracy, facilitates risk management, and contributes to overall organizational efficiency.