Despite having a hefty salary, the bank refuses to give loans to many customers. And when we ask the reason for the bank, the bank’s answer is that your CIBIL score is not good or it is negative. The bank checks the CIBIL score of the customers even before issuing the credit card. Actually, in this world of digital transactions, all kinds of facilities are now available online. Any transaction you do with the bank is seen at the time of taking the loan. Often the bank gives the loan to the customer only on the basis of the credit score.

The CIBIL score can be anywhere between 300 and 900, with 900 indicating the maximum creditworthiness. A CIBIL score of 750 or above in your credit report is ideal and will help you qualify for personal loans and credit cards.

Moreover, banks will not hesitate to give you a loan. Often people do not take loans and make payments on time. Late payment of EMI, non-payment of credit card on time, such steps adversely affect the CIBIL score.

Financial discipline means having a good credit score and it should not be a hindrance if you apply for any type of loan. For example, if you are going to marry a partner who is a defaulter on a credit card or personal loan and you want to take a joint home loan with him for a new house. Now a very difficult situation may arise for you. Might be possible, because of the partner’s credit score, the dream of your own house may remain incomplete.

What and Why credit score is important in CIBIL report:

CIBIL is the largest and oldest credit bureau in the country, having entered the market in the year 2000. It controls about 90 percent of the credit information market.

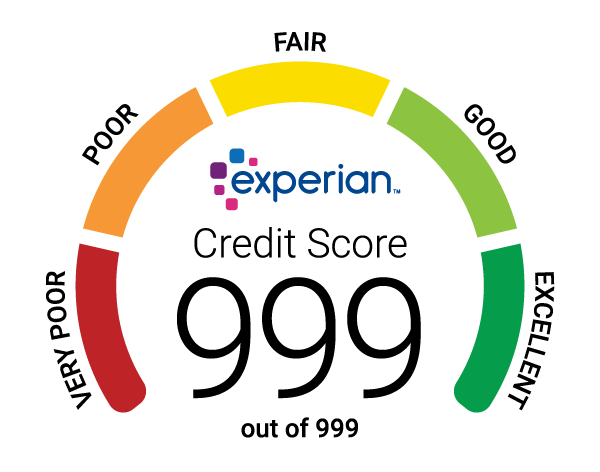

CIBIL or Credit Information Bureau (India) Limited is a credit bureau that calculates and maintains credit scores. CIBIL is the oldest, but there are three more credit bureaus that create your credit report – Experian, CRIF highmark and Equifax. Each credit bureau calculates your credit score on its own based on the data that banks provide to them from time to time.

Click Here to KnoW about EXPeriaN

ExperiaN is a leading global information services company, providing data and analytical tools throughout the world.

Experian is a secure and universally recognized credit announcement agency that provides professional credit assistance. Its services are ideal for users who need to increase their credit score by building a solid credit outlook. www.experian.in

A good credit score increases the chances of your loan application being approved.

But there is no guarantee that you will get a loan on the basis of a good credit score. Apart from the credit score, the loan income ratio of the applicant i.e. what percentage of your income is you paying towards current EMI (if any), job record, profession etc., also before the bank sanctions or rejects the loan is checked.

Needy of money but low CIBIL score

There are several ways in which you can choose to raise your low CIBIL score to a high CIBIL score.

You can start paying your credit card bills and loan EMIs on time. You should avoid making late payments under any circumstances. You can avoid excessive reliance on credit and keep the credit utilization ratio below 25%. If you find any incorrect information on the credit report, report it to the credit bureaus as soon as possible. For this, keep checking your credit score from time to time and if it is low, see if there is any wrong information in the report. You should not apply for a loan or credit card multiple times in a short period of time. It is advised to apply once after six months.

You shouldn’t close your oldest credit card. The longer your credit history, the more trust the bank has on you.

Maintain a balance in credit between secured credit (home loans, card loans, etc.) and unsecured loans (personal loans, credit cards, etc.).

Credit card limit is decreasing in COVID pandemic, know what you should do?

Due to the COVID pandemic, many challenges have come in the lives of common people. The biggest problem in this is about cash. The figures of withdrawing money from Provident Fund show that people are struggling with lack of money. However, all efforts have been made by the Reserve Bank to overcome this crisis.

The credit card limit is being reduced primarily for those customers who are availing the three-month moratorium on loan repayments. Banks believe that such customers will be short of money. In such a situation, the customer will use the credit card to meet the financial needs and there will be a delay in payment. Similarly, the limit is being cut for customers not using their credit cards.

If you want to maintain the credit card limit, then pay the credit card bill on time as soon as you spend the card money. If you spend more than 50% of the amount for a few months and pay on time, your credit limit will never be in trouble. With this your CIBIL score will also be correct.